I would like to purchase a charging station during 2020 and take the tax credit as i fill out my tax forms in early 2021.

Electric vehicle charging station tax credit 2017 form.

Notice 2016 15 updating of address for qualified vehicle submissions.

The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit.

If you installed charging equipment after january 1 2017 or if you install equipment before the end of this year you are eligible to claim this credit up to 1 000.

Can one take the credit for installation of a charging station if the vehicle being charged is not a full ev but is a ev series hybrid vehicle.

At least 50 of the qualified vehicle s miles must be driven in the state and the credit expires at the end of 2020.

All form 8936 revisions.

The 30 federal tax credit for installing electric vehicle charging stations at your home or business expired at the end of 2017.

A federal tax credit of 30 of the cost of installing ev charging equipment which had expired december 31 2016 has been retroactively extended through december 31 2020.

Notice 2009 89 new qualified plug in electric drive motor vehicle credit.

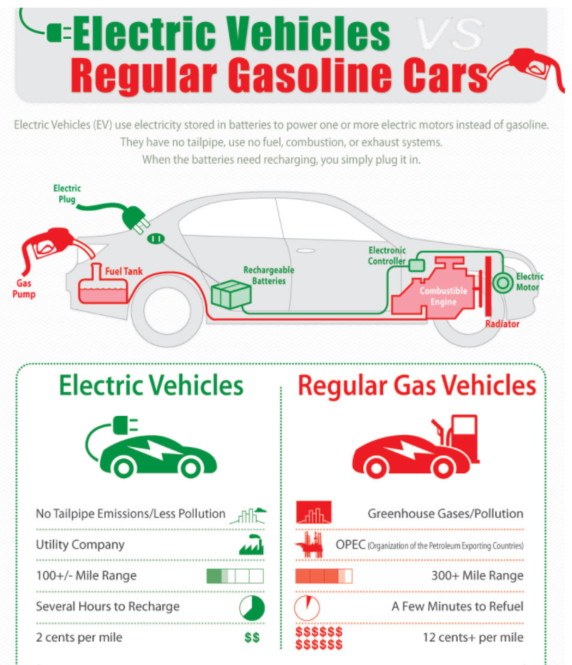

You may be eligible for a credit under section 30d a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14 000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source.

For 2019 enter the total of any credits on the 2019 form.

Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year.

As of 2019 the fate of federal tax credits for electric vehicle charging stations is somewhat unclear.

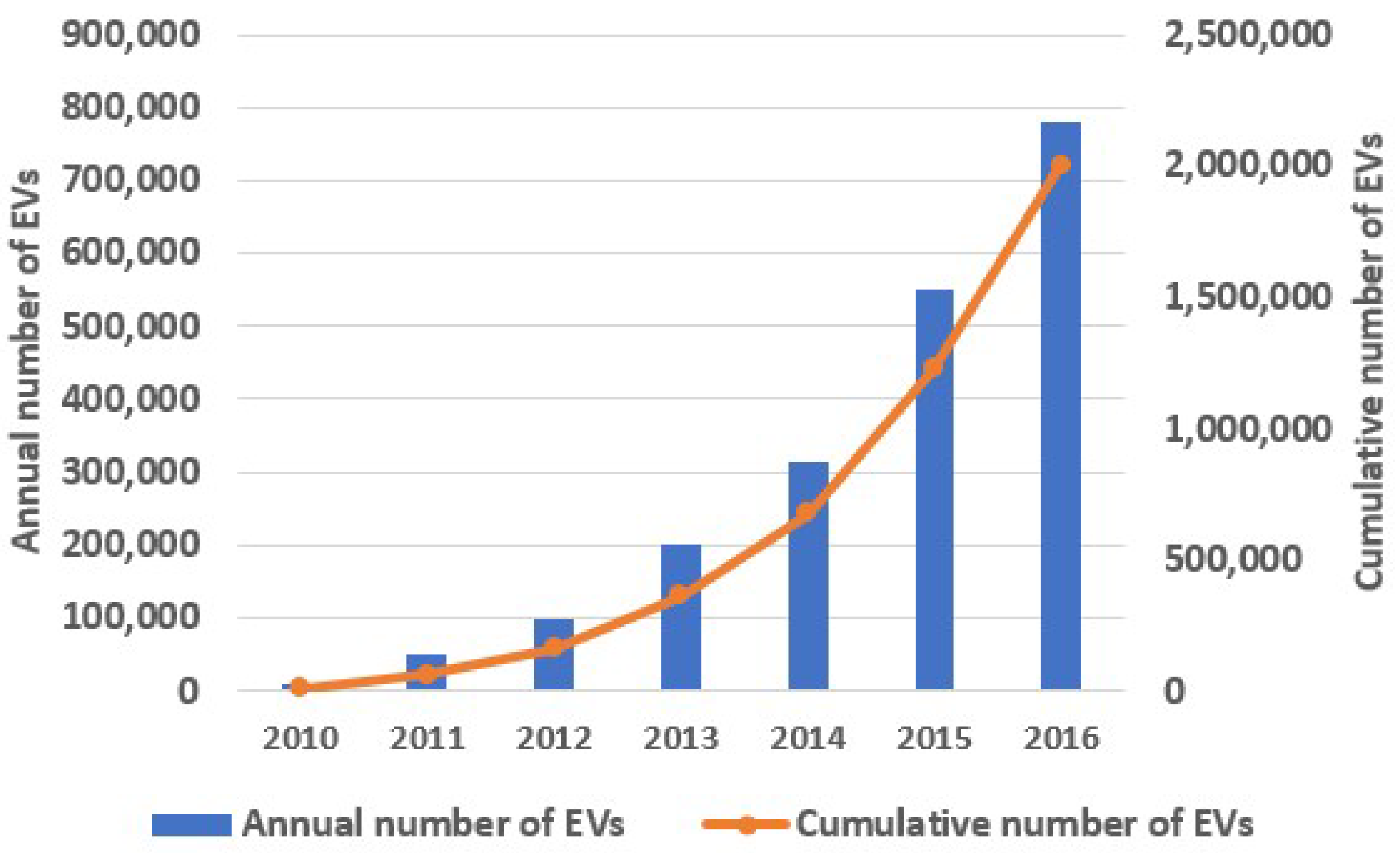

Tax credits for heavy duty electric vehicles with 25 000 in credit available in 2017 20 000 in 2018 18 000 in 2019 and 15 000 in 2020.

Minimum tax from form 8801 or any credit to holders of tax credit bonds from form 8912.

If you purchased a new vehicle that runs on electricity drawn from a plug in rechargeable battery you may be eligible to claim the qualified plug in electric drive motor vehicle tax credit which can reduce your tax bill.

Notice 2013 67 qualified 2 or 3 wheeled plug in electric vehicle credit under section 30d g.

In order to take the credit you must file irs form 8936 with your return and meet certain requirements.

About publication 463 travel entertainment gift and car expenses.

You must have purchased it in or after 2010 and begun driving it in the year in which you claim the credit.

However some states still have a tax credit for installing electric vehicle charging stations at your home.

To recharge an electric vehicle but only if the recharging property is located at the point where the vehicle is recharged.