How the equipment leasing calculator works.

Equipment lease rates calculator.

Our equipment leasing calculator allows you to estimate your monthly payments the balance to purchase the equipment at the end of the lease and the value of the equipment at the end of the lease.

The information provided by these calculators is intended for illustrative purposes only and is not intended to purport actual user defined parameters.

To calculate enter the equipment s cost rate term your down payment and then select the type of.

By comparing these amounts you can determine which is the better value for you.

With our calculator you can choose from three of the most popular equipment lease types to calculate your payments.

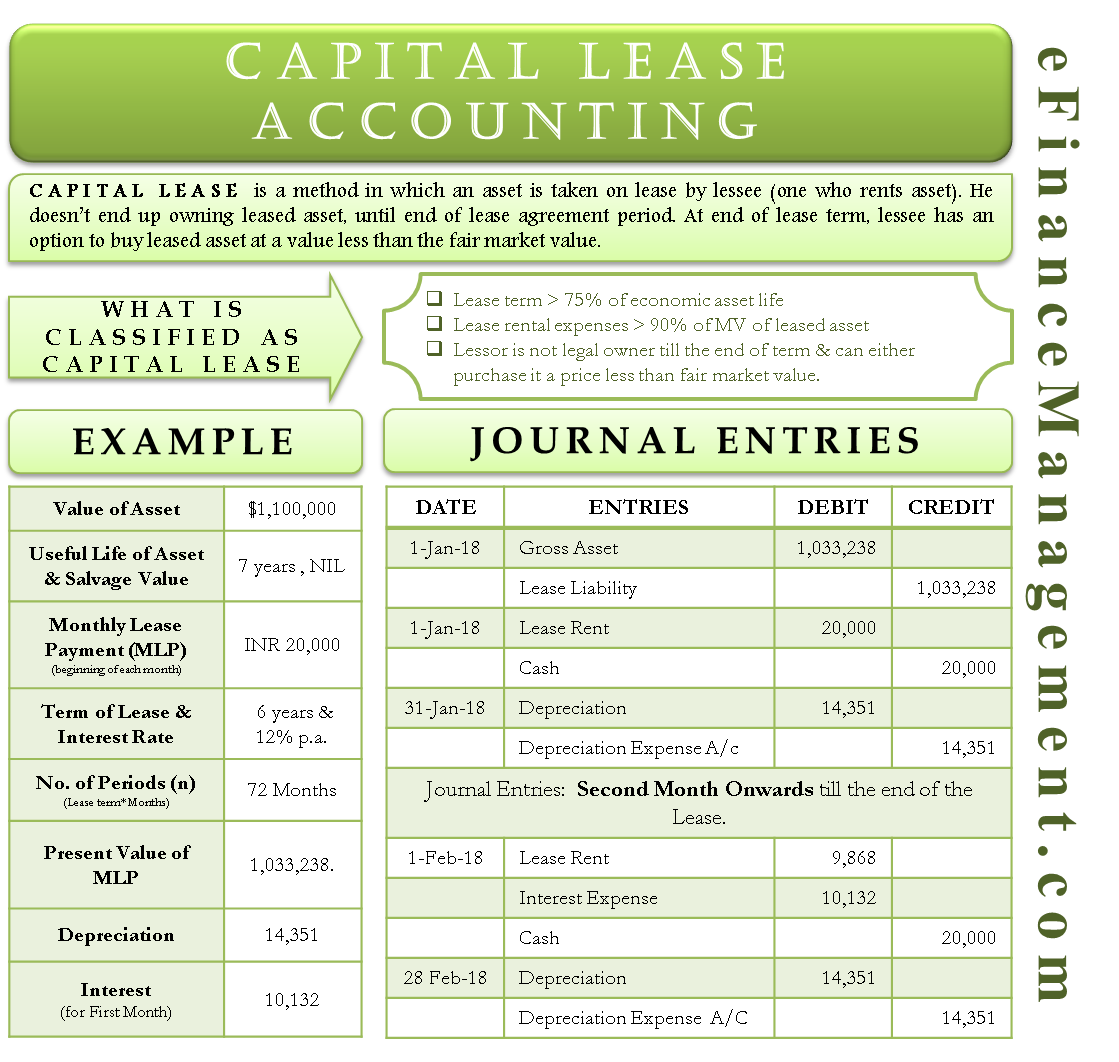

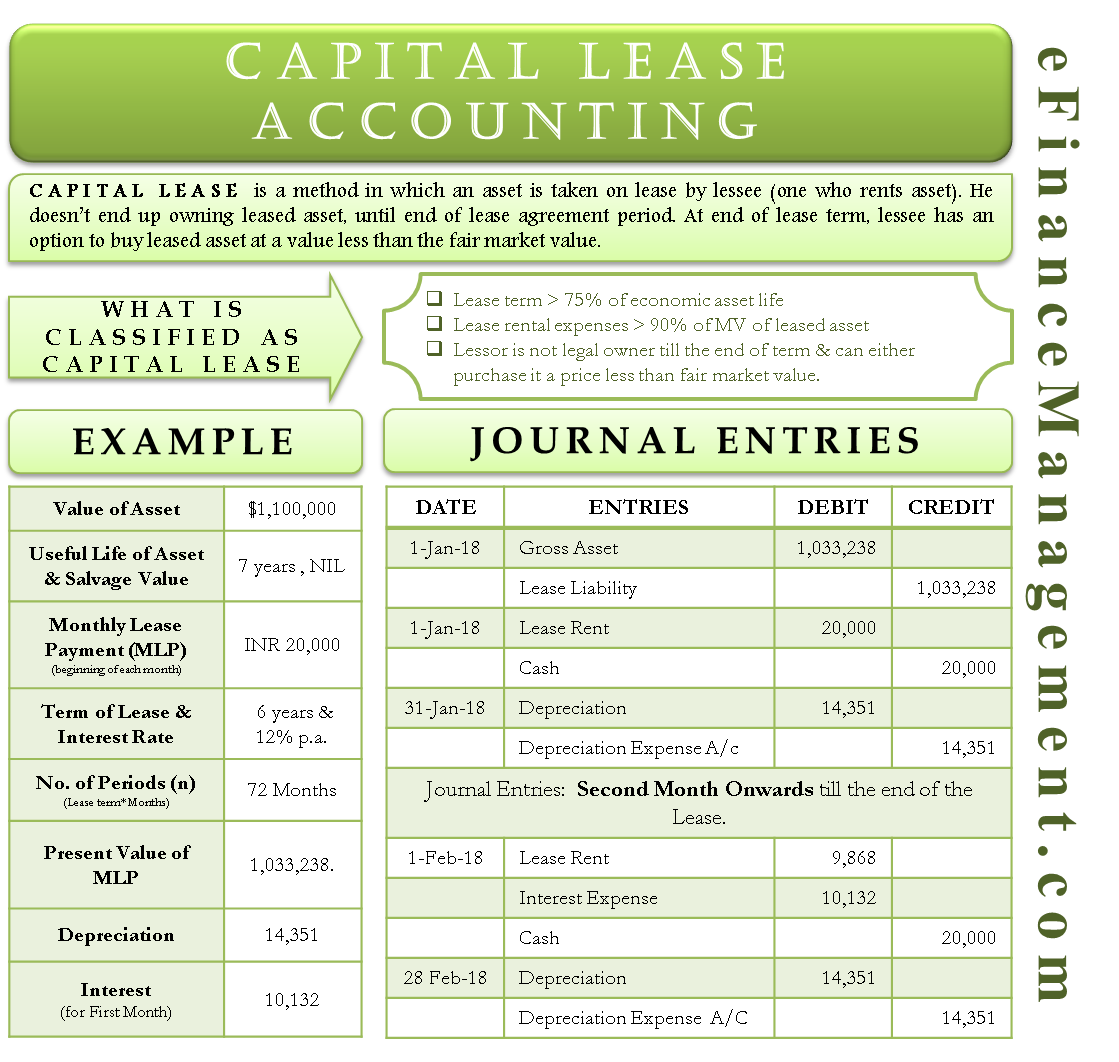

The benefit of a capital lease or finance agreement is that the customer may deduct 1 000 000 in equipment purchases to offset taxable income.

The bonus depreciation adds further benefit above this amount.

The 1 buyout lease a capital lease in which the lessee makes fixed payments each month and then has the right to purchase the leased equipment for 1 at the conclusion of the lease period.

Our lease with the 1 00 purchase option and equipment finance agreement would qualify under section 179.

What is my equipment lease rate.

This calculator computes the lease rate based on a known payment amount lease amount residual amount and lease term.

Also gain some knowledge about leasing experiment with other financial calculators or explore hundreds of calculators addressing other topics such as math fitness health and many more.

Should you lease or buy.

We calculate monthly payments and your total net cost.

Use this calculator to find out.